Cigna VHIS Series – Flexi Plan (Superior)

Enjoy a limited-time 3 months premium refund and earn 3,000

Looking for a better VHIS plan for yourself and your family? Now's the time to enrol in 'Cigna VHIS Series – Flexi Plan (Superior)' to enjoy 3 month premium refund on next year's premium and miles rewards for comprehensive health protection.

Limited time offers

Premium Refund

Successfully apply for insurance during the promotion period and enjoy a 3-month premium refund for the following year, equivalent to a 25% discount, making it easy to maintain comprehensive medical coverage.

Earn 3,000

Successfully apply for the Cigna VHIS Series – Flexi Plan (Superior) and earn 3,000. Gear up for health effortlessly with tax deduction¹ and bonus milage reward in simple enrolment steps. It’s time to stride towards a healthier milestone without worry!

The plan is right for you if you...

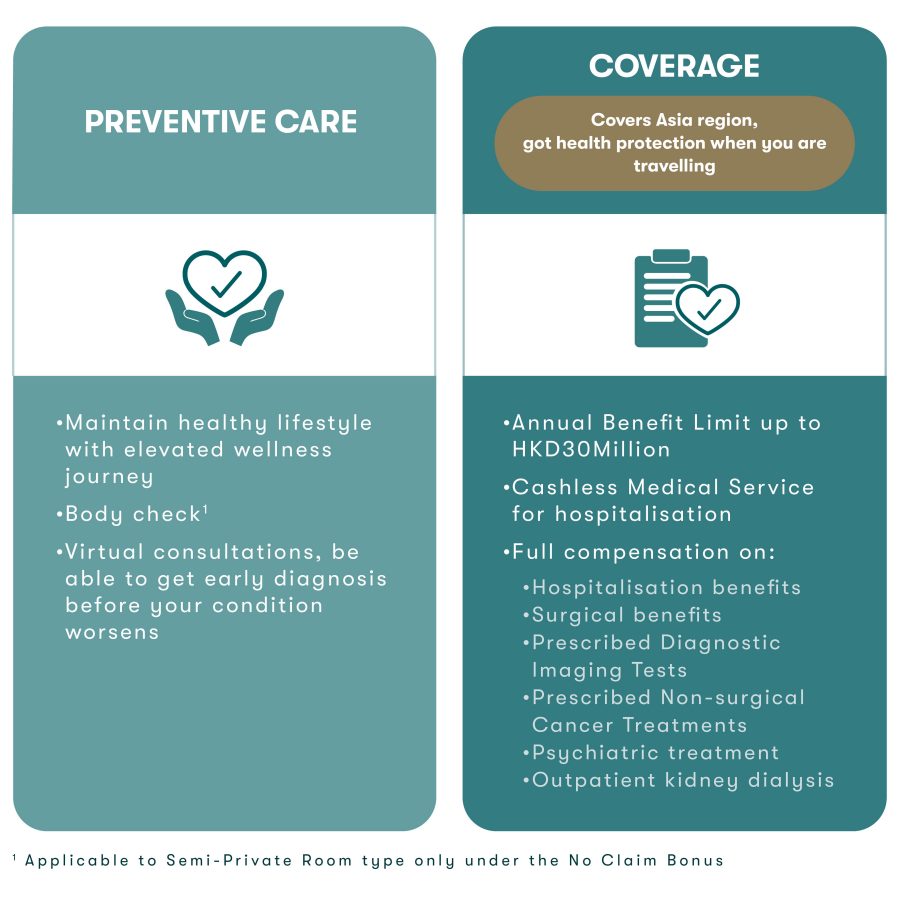

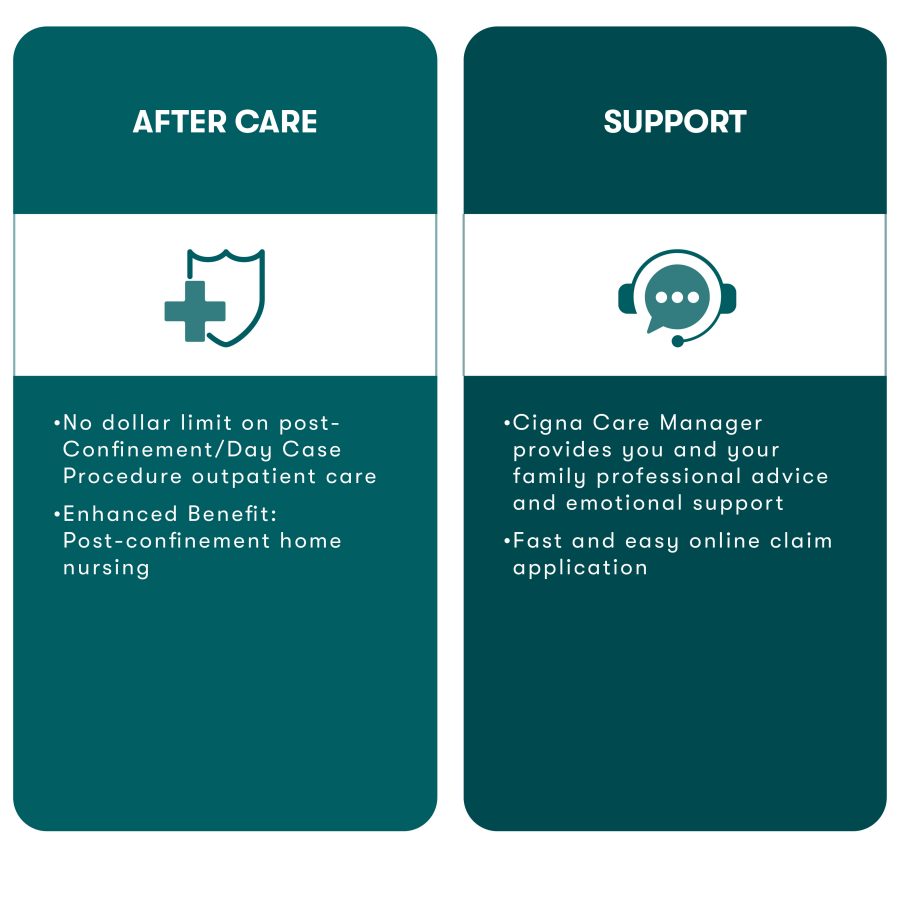

Key benefits of the plan

Elevate your health plan

Member Get Member Reward

Refer a friend to enrol Cigna VHIS Series Flexi Plan (Superior), both of you can earn 1,000 after successful enrolment. Contact a Cigna Customer Advisor at +852 8100 2040 to participate. Terms and conditions apply.

All-round support from Cathay and Cigna Healthcare

Obtain product information

Cathay is an insurance agent appointed by Cigna Healthcare (FA3522). Detailed product information is available on Cathay's website, with member exclusive promotions listed from time to time. Members can opt for suitable health medical plans according to individual needs.

Make a Claim

Simply download the MyCigna HK mobile app or visit www.mycigna.com.hk to upload supporting documents to file a claim. For further assistance, please call the customer hotline at +852 8100 3209.

Healthcare Concierge Service

Whenever you encounter a health issue, contact Cigna Healthcare at +852 2560 1990 for tailored healthcare assistance from Cigna Care Managers. Staffed by qualified nurses to address your medical inquiries, the service offers professional advice and develops a customized care plan just for you.

*Not applicable to Cigna DIY Health Plan

Cigna customer service hotline

Designated hotline for respective insurance plans:

Cigna Cathay Premier Health Plan: +852 8100 3209

Cigna VHIS Series – Flexi Plan (Superior),

Cigna Plus Health Plan or Cigna DIY Health Plan: +852 2560 1990

¹ The maximum tax deduction is HK$8,000 per insured person per year, with no cap on the number of policies or dependents you claim a deduction for. Terms & conditions apply.